[ad_1]

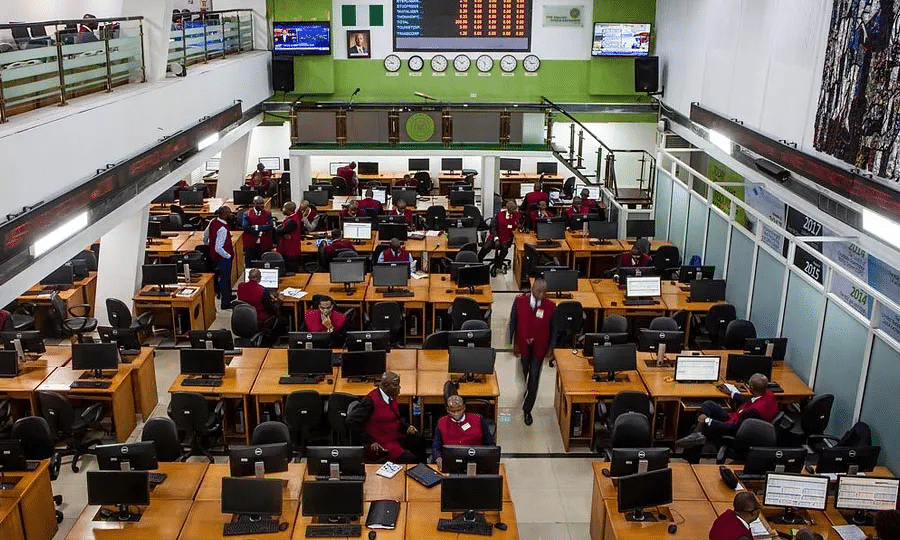

Wednesday, September 08, 2021 / 6:47 PM / Ottoabasi Abasiekong for WebTV / Header image credit: WebTV

Investors support and show great interest in long-term financing geared towards specific projects covering areas such as electricity, housing and infrastructure, among others. The statement was made by the President of the Chartered Institute of Securities Brokers, Mr. Olatunde Amolegbe, FCIS, during a conversation on “Evaluating the FGN’s Partnership with Securities Brokers to Deepen the Capital Market “.

According to him Nigeria faces an infrastructure shortage challenge that can be better supported with long-term financing. He said that in the past, states and even local governments used to access the capital market to raise capital for critical socio-economic projects.

At the turn of the millennium, there was a move towards a faster way to raise funds through the money market, but for longer-term projects, the capital market was more suitable, he noted.

Amolegbe urged governments at different levels to prioritize funding for projects through the capital, which he saw as more sustainable while citing the example of the popular Sura market in Lagos than the local government of Lagos Island. built with funding from the capital market.

Considering that Nigeria has an estimated housing deficit of 17 million units, Amolegbe urged states and local governments to explore the capital market to raise funds to finance housing projects. He added that the capital market offers transparency, which boosts investor confidence.

Speaking on the investment outlook for pension funds, he said the current guidelines were about security, he said the market regulator was trying to strike a balance between risk and return.

The CIS president also noted that pension funds were prioritized so that holders of Retirement Savings Accounts (RSA), who were relatively young, could explore riskier assets to improve their returns. investments.

Expressing his point of view on how policies and regulations can spur more activity in the market, he cited the example of the Bank of Industry (BOI) whose Managing Director, Mr. Kayode Pitan during the A recent investiture said the BOI had approved concessional lending rates. companies listed on local stock exchanges.

Amolegbe stressed the need for growth companies in Nigeria to use the capital market for funding. He called on the Bureau of Public Enterprises (BPE) to insert clauses for the privatization of enterprises, which would guarantee their listing on a local stock exchange after a certain period.

He gave the examples of the National Aviation Holding Company (NAHCO) and Sky Aviation Handling Company Limited (SAHCOL) as companies that have been privatized and listed on a local stock exchange.

On the CIS “honor roll”, he said it was an opportunity to appreciate all the distinguished people, institutions and corporations who have contributed to the completion of his secretariat in Lagos.

Related video

Related news

- FG partners with securities brokers for optimal use of the capital market

- Collaboration between registrars and capital market operators, key to resolving unclaimed dividends

- NGX Securities Lending Market Value Rises To Naira 513 Million

- NGX CEO sees technology as a strategic lever for the exchange of the future

- NGX Highlights Opportunities in Green Bonds and Sukuk

- NGX Transitions X-FactBook to Digital Publication and Releases 2021 Edition

- Nigerian Exchange Group commemorates 60 years of building Africa’s largest economy

- NGX and NGCL Engage Trading Licensees on Derivatives Trading

[ad_2]

No Comment