gains tax

2022 capital gains rates are better than ever

Selling stocks at a profit can be a major win for your bank account. But it can also come with a hefty tax bill if you’re not careful. The IRS won’t let you slip away without paying capital gains tax. Fortunately, patient investors are rewarded in the stock market with special rates. For 2022, these …

Do I have to pay capital gains tax if I sell bitcoin?

I invested £10,000 in bitcoin at the end of 2020 and despite it falling from the November peak, I still tripled my money. My initial investment of £10,000 is now worth around £30,000 and I am considering selling half of it and investing in some investment trusts I had my eye on, to take advantage …

Capital gains tax comes into effect delayed to 2024

The implementation of the capital gains tax has been delayed for another two years to reduce the impact of the pandemic on the property market as the government rolls out a series of stimulus packages for economic recovery. The Ministry of Economy and Finance said in an announcement dated March 9 that the ministry has …

What is a capital gains tax? – Daily Macomb

Q: We have lived in our house for 34 years. When we sell it, will we have to pay capital gains tax? My husband thinks we will because his parents had to when they sold their house almost 40 years ago. A: It’s been a few years since I touched on this topic, but it’s …

Capital gains tax: Should you report your cryptocurrency holdings or profits to HMRC? | Personal finance | Finance

Capital gains tax is a levy on the profit a person makes when they sell or give away something that has increased in value. But what are the rules when it comes to cryptocurrency like bitcoin? Britons who sell assets whose total taxable gains exceed their annual capital gains allowance of £12,300 are required to …

Tax on Capital Gains in Nigerian Capital Market and Equity Investments under the Finance Act 2021 – Taxation

To print this article, all you need to do is be registered or log in to Mondaq.com. introduction It is now a well-established norm that tax laws are periodically reviewed in Nigeria in line with the National Tax Policy adopted by the Federal Executive Council in 2018.1. Since 2019, the National Assembly has always accompanied …

Rich made the bulk of long-term stock gains in FY20: Revenue Secretary

NEW DELHI : Most of the long-term capital gain on stocks in FY20 was realized by people ₹50 lakh and above, Revenue Secretary Tarun Bajaj said on Monday, pointing out that the tax introduced in the 2018 Finance Act on long-term capital gains served as a fair tax. Long-term capital gains on shares held for …

Newshub-Reid Research poll finds majority of Kiwis support government review of capital gains tax

Mom Florence Curr is looking for a house, but it’s difficult. “House prices are going up, interest is going up, everything is very expensive,” she says. That’s record inflation of 5.9% for you. To get it under control, and to no one’s surprise, Reserve Bank Governor Adrian Orr announced on Wednesday that the OCR would …

Capital gains tax repeal is a long shot – Slog

Washington’s capital gains tax would only hit people who have made millions by investing their money in Wall Street, venture capitalists and hedge funds. Bo Zaunders/Getty Images People who plan to repeal Washington state’s new capital gains tax with a statewide ballot initiative are showing a boldness the size of Bezos balls. Sponsored According to …

Save on Capital Gains Taxes with a 1031 Exchange

1031 Exchanges must be of the same nature Article 1031 of the Internal Tax Code clarifies that no gain or loss should be recognized on the exchange of one investment property for another, as long as they are of the same nature. This doesn’t mean you have to trade your building for another – it …

Keep capital gains tax to spur buy-to-let: CFO

Last year the government suspended plans to reform capital gains tax, but industry experts warn the threat of a future rise could impact the private rental sector. In December last year, the Treasury ignored previous suggestions from the Tax Simplification Office (OTS) to reduce capital gains tax rates to the same level as income tax, …

Capital gains tax reduction: how to reduce your liability to CGT | Personal finance | Finance

It generally applies to stocks, investment funds, secondary properties, inherited properties, the sale of a business or valuables, including works of art, jewelry and antiques. worth £6,000 or more. Failure to report capital gains tax on assets may result in a fine. Individuals have 60 days from the date of transfer to declare a disposal …

How to Calculate Capital Gains Tax on Rental Property

You didn’t quote the pension figure for 2017, but inflation has risen by 9.575 pc since then, so we can estimate that your pension was then ($1,300 x [100 – 9.575] =) $1175.50 per fortnight. (Hope you weren’t too careless rounding your pension up or down.) This means the special value is ($1175.50/14 x 365 …

Explained: Increased Capital Gains Tax Recoveries

In an almost Multiplication by 10 of tax collections on the stock markets, the government expects to collect Rs 60,000-80,000 crore in this fiscal year as capital gains tax on stock markets, up from Rs 6,000-8,000 crore in the fiscal year. previous. Revenue Secretary Tarun Bajaj said the government estimated a “good amount” of capital …

Simpler structure: capital gains taxes could be revised

The current regime is “complicated,” says earnings privacy, hinting at changes. The government is ready to simplify the capital gains tax regime at the next opportunity, a senior official said on Wednesday, leading analysts to expect a reduction in the tax impact on gains resulting from the sale of unlisted stocks, real estate investment units …

Capital gains tax regime needs change: Revenue Secretary Tarun Bajaj

Revenue Secretary Tarun Bajaj said on Wednesday that the current capital gains tax regime needed a fresh look and that the different rates and holding periods also needed to be streamlined. Speaking at an event organized by industry body Confederation of Indian Industry, Bajaj also said that if the Center had not …

2021 Finance Law – Impact on the capital market and the real estate sectors – Finance and Banking

Nigeria: Finance Law 2021 – How the capital market and real estate sectors are impacted February 08, 2022 Udo Udoma & Belo Osagie To print this article, all you need to do is be registered or log in to Mondaq.com. INTRODUCTION The Finance Act 2021 (the “FA 2021”) introduced changes that could …

What are the new capital gains rates for 2022?

Large capital gains are good news for your investment account balances, but bad news when … [+] it’s about your taxes each year. Getty Although the stock market had a tough January, if you’ve been investing for a while, you’ve probably racked up capital gains over the past few years. Many projections for the rest …

Capital Gains Tax: You Could Lower Your Bill By Acting Now – How To | Personal finance | Finance

It generally applies to stocks, investment funds, second properties, inherited properties, the sale of a business, or valuables including works of art, jewelry and antiques. worth £6,000 or more. It is possible to limit the liability to tax on capital gains by making the most of the losses to reduce the gain. Indeed, all gains …

Capital gains tax warning from CFO celebrating…

A finance chief warns that the threat of possible capital gains tax hikes should be brushed aside by the government to help the buy-to-let sector. Jonathan Samuels, managing director of Octane Capital, said: “The government has done its best to curb investment in the private rental sector in recent years, with a series of legislative …

Homeowners face significant capital gains taxes

Brendan Green Marc McCue Section 1031 of the Internal Revenue Code (IRC) allows an owner, who holds property for “productive use in a trade or business or for an investment”, to defer payment of taxes on capital gains. capital if the owner sells that property, identifies a “like kind” property within forty-five days of the …

Capital Gains Tax on ULIP Income Under the Last Budget

NEW DELHI: The government did not impose any new tax on unit-linked insurance schemes (ULIP), but simply implemented last year’s budget announcement through a circular, Tax Department sources said Monday. The 2021 finance law also inserted a provision in the income tax law to make income from ULIPs taxable as capital gains, just like the …

Do you have to pay capital gains tax? Only if total earnings exceed your annual CGT allowance | Personal finance | Finance

People must notify Her Majesty’s Revenue and Customs (HMRC) if their taxable earnings are more than four times their allowance. They must also report their earnings on their tax return if they have registered for self-assessment. A self-assessment (or Form SA100) is a system used by HMRC to determine the amount of income tax and …

Union Budget 2022-23: Government to consider capital gains tax relief for global bond investors

Union Budget 2022-23: Government Considers Capital Gains Tax Relief for Global Bond Investors | Photo credit: iStock Images In the upcoming Union Budget 2022-23, Finance Minister Nirmala Sitharaman is expected to consider a likely capital gains tax exemption for foreign debt securities ahead of the inclusion of India’s sovereign bonds in global bond indices, according …

Finance law: 10% capital gains tax could discourage capital market investment – Taiwo Oyedele

The recent amendment to the Finance Act 2021 which requires investors in the Nigerian Stock Exchange to pay a capital gains tax of 10% on the sale of shares applicable to the disposal of shares worth 100 million naira and more, can discourage investment in the capital market and refocus attention on government securities. This …

Letter: Stamp duty and capital gains are hampering the UK market

To avoid the ‘Jurassic Park’ label you warn about in your editorial ‘How to revive London’s flagging stock market’ (FT View, FT Weekend, January 8), London markets are demanding action from investors, regulators and the government. US stock exchanges do not charge stamp duty. In the UK, most private investors risk capital gains tax (CGT) …

Crypto Exchanges In Thailand Would Now Subject To A 15% Capital Gains Tax By Cointelegraph

[ad_1] The Thai government is making progress in regulating the local cryptocurrency ecosystem by promulgating new tax rules for the industry. Profits from crypto trading in Thailand now subject to 15% capital gains tax, according to The Bangkok Post news agency reported Thusday. Continue reading on Coin Telegraph Warning: Fusion media would like to remind …

Thai Ministry of Finance Announces 15% Capital Gains Tax on Cryptocurrencies

Thailand’s Ministry of Finance reveals cryptocurrency taxation standards and asks traders to prepare for increased scrutiny. Cryptocurrency exchanges will be exempt from Thai tax standards. Retail investors and miners are covered by Thailand’s new crypto tax rules. Thailand’s Ministry of Finance has revealed new standards for the taxation of cryptocurrencies. Retail investors and miners are …

Crypto exchanges in Thailand would now be subject to a 15% capital gains tax

The Thai government is making progress in regulating the local cryptocurrency ecosystem by enacting new tax rules for the industry. Profits from crypto trading in Thailand are now subject to a 15% capital gains tax, according to news agency The Bangkok Post reported Thusday. Thailand’s revenue department also plans to strengthen its oversight functions following …

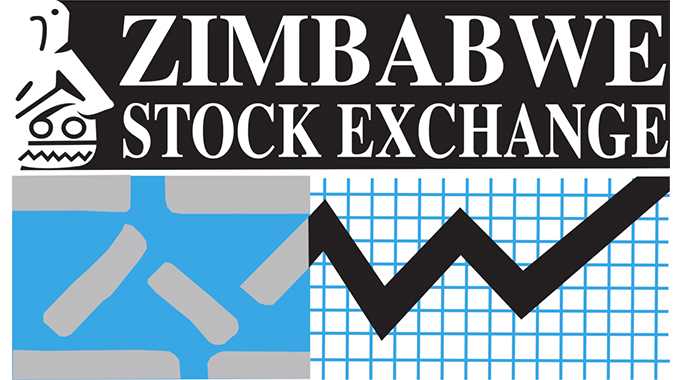

Withholding tax on capital gains increased to 2%

[ad_1] The Chronicle Oliver Kazunga, Senior Business JournalistThe Zimbabwe Stock Exchange (ZSE) announced a 2% increase in the withholding tax on capital gains starting this month, in line with the 2022 fiscal policy framework. The government, through the Ministry of Finance and Economic Development, had defined the framework for the new tax regime in the …

Benefit of the rich as Democrats waive unrealized capital gains tax

[ad_1] Democrats appear to have rejected the idea of ​​taxing returns on unsold inventory and other assets, favoring other means of generating income amid a nearly $ 2 trillion social and climate bill. The elimination of this tax on “unrealized capital gains” would mainly benefit the wealthiest Americans, who hold most of the country’s financial …

3 easy strategies to avoid capital gains tax

[ad_1] Tthe end of the year is a time for reflection, and this also applies to your investment accounts. Many people choose to rebalance their portfolios at the end of the year, so it’s especially important to know the effect of your trading actions on your upcoming tax bill in April. Below are three easy-to-apply …

Take action before the end of 2021 to reduce your capital gains taxes

[ad_1] VSCapital gains taxes are the taxes you may have to pay when you sell investments for a profit. Although taxes on long-term capital gains are lower than taxes on short-term capital gains, any kind of taxes you owe can still reduce your effective returns. The good news is that there is a simple technique …

How to report capital gains on gold and property in ITR

[ad_1] Profits made on the sale of real estate or gold are treated as capital gains. The tax rate on these capital gains depends on the length of time the asset is held. Capital gains realized on the sale of gold held for more than three years are assimilated to a long-term capital gain (LTCG) …

/cloudfront-us-east-2.images.arcpublishing.com/reuters/UHUIA22JDNMQ5DFTITHZ5OJTXY.jpg)

Japan implements tax reform to raise wages as part of “new capitalism” plan

[ad_1] Japan’s new Minister of Economy, Trade and Industry Yoichi Miyazawa speaks at a press conference at his ministry in Tokyo on October 21, 2014. REUTERS / Toru Hanai Register now for FREE and unlimited access to reuters.com Register Power bloc agrees on tax reform plan for fiscal year 2022 Focus on the wage increase …

Capital gains tax on ALL dwellings

[ad_1] A new report wants the government to consider imposing a capital gains tax on profits generated from appreciating home values ​​for all properties, not just others. The report says existing home owners, and especially those who bought in the late 1990s and early 2000s, made what it calls “largely unearned gains.” The report, from …

South Korea eases capital gains tax on home sales from Wednesday

[ad_1] South Korea has removed the capital gains tax on the sale of homes worth up to 1.2 billion won, or about US $ 1 million for those who own only one house. The Economy and Finance Ministry said the policy would go into effect on Wednesday. Before the change, capital gains taxes came into …

Inheritance Tax and Capital Gains Tax at SOAR as Sunak Snubs Hated Levy Reform | Personal Finances | Finance

[ad_1] In March, Chancellor Rishi Sunak froze the threshold at which you pay both inheritance tax (IHT) and capital gains tax (CGT) for five years. Rebecca O’Connor, Head of Pensions and Investments at Interactive Investor, said: “Both taxes are going to gradually take more and more of our money.” Many still believe that inheritance tax …

capital gains tax: documents necessary to prove that the parcel sold is agricultural land to avoid capital gains tax

[ad_1] In each edition of ET Wealth, our panel of experts answer questions related to any aspect of personal finance. If you have a question, send it to us immediately at [email protected]. I bought agricultural land near Mohali in 1995 for around Rs 20 lakh. The plot is currently worth over Rs 2.5 crore. I …

Egyptian Senate proposes package of tax reforms to boost capital market investment – Politics – Egypt

[ad_1] “The Senate and the government have agreed that it is necessary to stimulate investment in the capital market and the first step in achieving this is to resolve the tax issues that could negatively affect the flow of investment in the capital market.” , indicates the report. The reform proposals were tabled by Senators …

What will the proposed changes in capital gains rates mean for real estate investors?

[ad_1] WWe talked about it, and with the Biden administration, there’s a new sheriff in town. With the new sheriff, many changes in tax law will have a major impact on real estate investors. One surprising proposed change is the change in capital gains tax rates that are part of the Build Back Better Act. …

/cloudfront-us-east-2.images.arcpublishing.com/reuters/E4E7BACRUNKOXFUXNRCAAOGTWA.jpg)

Japan plans to debate capital gains tax hike next year – Media

[ad_1] People walk at a level crossing in the Shibuya shopping area, amid the coronavirus disease (COVID-19) pandemic, in Tokyo, Japan on August 7, 2021. REUTERS / Androniki Christodoulou PM Kishida abandons financial tax review for now Tax hikes could help close income gaps Some investors worry about the impact on the stock market TOKYO, …

Should cryptocurrency income be taxed as capital gains? How? ‘Or’ What?

[ad_1] Failure to report crypto trading income / loss may result in criminal consequences When the coronavirus pandemic swept the world, shutting down businesses and other economic activities, a certain gloom reigned around the markets. But the rise of cryptocurrency has helped dispel some of the uncertainty. People have decided to invest in this emerging …

What’s next for income and capital gains tax?

[ad_1] The budget came and went and, pretty much as expected (given the important tax and national insurance announcements in March and September), nothing more important to financial planners was announced. Thus, in the spirit of doing the basics well in a context of apparent stability in relation to income tax and even capital gains …

The Treasury will approve on Monday the new tax on capital gains to guarantee the recovery of municipalities – CVBJ

[ad_1] DANIEL VIAA MARA HERNNDEZ Updated Friday, November 5, 2021 – 2:33 PM The ministry of Mara Jess Montero is working to bring to the Council of Ministers a text adapted to the judgment of the Constitutional Court Finance Minister Mara Jess Montero at the Congress of Deputies yesterday. JM CADENAST Courts The Constitutional Court …

The madness of taxing unrealized capital gains – OpEd – Eurasia Review

[ad_1] By Georg Grassmueck * President Biden’s proposal to require about 700 US billionaires to pay taxes each year on unrealized capital gains has garnered broad support from Democrats as another step to make the rich pay for uncontrolled government spending. federal. House of Representatives Speaker Nancy Pelosi said Democrats hope the plan would raise …

ATO determining whether DeFi investments trigger capital gains tax

[ad_1] The Australian Tax Office (ATO) looks to the world of decentralized finance (DeFi). In a statement to nestegg, the ATO confirmed that it is taking a closer look at crypto-based financial platforms like Celsius and how they fit into the current fiscal framework. “The ATO is examining various decentralized financial platforms and working to …

Rashedul Hasan, CEO of UCB Asset Management

[ad_1] Contrary to many opinions, investment manager Shekh Mohammad Rashedul Hasan believes that the Bangladesh capital market offers a significant opportunity to build long-term wealth in a sustainable manner. “Our capital market is much more promising than it looks,” said Hasan, Managing Director and CEO of promising next-generation asset management firm, UCB Asset Management – …

Short-term capital gains tax rate for 2021

[ad_1] Federal tax documents Capital gains tax generally applies when you sell an investment or asset for more than what you paid for it. In other words, all profits from the sale are considered taxable in the eyes of the Internal Revenue Service. Whether you pay the tax rate on short-term capital gains or long-term …

Amid inequality debate in Japan, hike in capital gains tax could have an unexpected effect

[ad_1] The issue of growing inequalities and the question of how to deal with it have featured prominently in the Lower House election campaign, which ends on Sunday, with even the right-wing Liberal Democratic Party incorporating related policies into its manifesto. But a measure that previously seemed to be a key policy has been notoriously …

Washington voters to weigh in on new capital gains tax

[ad_1] On May 4, Gov. Jay Inslee (D) signed a law creating a 7% capital gains tax, which will come into effect next year. On November 2, lawmakers in Washington will hear what voters think. While the poll metric asking voters to recommend whether to keep or repeal the new tax is purely advisory, this …

NSW Planning Department gets it wrong on capital gains tax appeal

[ad_1] The Property Council of Australia today reminded all governments that a better deal – not higher taxes on new housing – is the answer to the challenges of housing affordability. The NSW Planning Department recommended increasing the capital gains tax on investment property in a submission to the major federal inquiry into affordability and …

NSW Targets Capital Gains Tax Relief For Real Estate Investors To Help First-Time Home Buyers

[ad_1] The New South Wales government has targeted controversial tax breaks for property investors, suggesting they are pushing first-time homebuyers out of an increasingly competitive property market. Key points: State government wants capital gains tax cut to be revised Currently, people who have owned real estate for more than a year only have to pay …

Tax implications on capital gains realized by NRIs

[ad_1] Taxation depends on the residence status of the individual. For example, a resident taxpayer must pay tax on his aggregate income; however, a Non-Resident Indian (NRI) is only subject to income tax on income from Indian sources. NRIs can invest in stocks and mutual funds, as long as they comply with the provisions of …

Ministry of Finance aims to increase sources of finance, capital market demands tax justice

[ad_1] The opening session of the Capital Markets Summit discussed capital gains tax and its impact on the market. The summit touched on the hot topics of Egyptian capital markets, how the Egyptian stock exchange can meet the aspirations of the state by offering large state-owned enterprises such as the Administrative Capital for Urban Development …

The merger of an accounting firm in capital gains tax now celebrates its two years of activity

[ad_1] WealthVisory was launched in 2019, through the merger of two experienced accounting firms in Mandurah. The agency is a chartered accountancy firm that offers personalized, down-to-earth solutions for business and personal accounting. WealthVisory and Aaron Colley, Principal, are pleased to announce that the capital gains tax accounting firm was formed in 2019 by the …

Appropriate economic and distributional analysis is needed if capital gains tax is to be introduced, according to MICPA and Deloitte

[ad_1] KUALA LUMPUR (October 12): Appropriate economic and distributional analysis will need to be carried out if the government intends to consider a full-fledged capital gains tax (CGT), Malaysian Institute of Experts said -chartered accountants (MICPA) and Deloitte Malaysia. Indeed, the country is still a developing country and competes with foreign direct investment with various …

Tokyo fills up in the morning as Prime Minister Kishida delays capital gains tax hike

[ad_1] People walk past the electronic board of a securities firm in Tokyo on October 11, 2021. (AP Photo / Koji Sasahara) TOKYO (Kyodo) – Tokyo shares rose on Monday morning as market sentiment improved after Prime Minister Fumio Kishida said at the weekend he would not immediately raise the tax rate on capital gains. …

Income Tax, Inheritance Tax and Capital Gains Tax to Increase AGAIN as UK Debt Explodes | Personal Finances | Finance

[ad_1] Today’s near zero borrowing costs saved the UK by lowering the cost of servicing our debts, but interest rates now look set to soar as inflation takes off. A financial expert warns that Sunak sleeps on a “bed of nitroglycerin” and that taxpayers will have to foot the bill if he explodes. The Bank …

/cloudfront-us-east-2.images.arcpublishing.com/reuters/TBATSOHAFVOP5C6BNQTOB75L6A.jpg)

Japanese Prime Minister Kishida says he has no plans to change capital gains and dividend taxes

[ad_1] New Japanese Prime Minister Fumio Kishida delivers his first political speech to parliament in Tokyo, Japan on October 8, 2021. REUTERS / Kim Kyung-Hoon Prime Minister called review of these taxes an “option” to correct the wealth gap New tax stance indicates concern in nervous markets The PLD’s draft electoral campaign plan does not …

Tax time is approaching. How Lossy Stocks Offset Capital Gains.

[ad_1] Text size The harvest usually speeds up in the fourth quarter. The time of dreams Taxes don’t really have a season on Wall Street, and a slew of stocks that have been on the losing side will be sold by the end of the year to lower IRS bills. This is called tax loss …

I rented my basement. Am I liable for capital gains tax on the sale of the house?

[ad_1] My house is now on the market, so this request is really urgent. I bought a three-story Victorian house twenty years ago and a few years later rented the basement to make it a self-catering apartment. I took the stairs off, and it’s only accessible through its own side door. I signed up for …

The deputy wants to reduce the capital gains on French second homes (in some cases)

[ad_1] A proposal to change the taxation system for second homes, reducing rates in certain circumstances, was put forward by a member. Under current rules, owners of second homes in France are taxed on capital gains when selling real estate (the tax is based on the difference between the initial purchase price and the sale …

Tax on unrealized capital gains, explained

[ad_1] Currently, the tax code stipulates that unrealized capital gains are not taxable income. This means that someone who owns stock or property that increases in value does not pay tax on that increase until they actually sell that asset. This policy allowed the richest Americans to get richer by minimizing their tax obligations. What …

AT A GLANCE: Personal income, capital gains… taxes levied by the State of Lagos

[ad_1] The Lagos State Government has joined the lawsuit challenging the collection of value added tax by the Federal tax service (FIRS). Before that, the state has established a law to impose and invoice VAT as a court of appeal ordered states to maintain the status quo pending the decision of an appeal filed by …

Federal capital gains tax reform would also benefit states – ITEP

[ad_1] The action or inaction of Congress on the federal tax changes contemplated in the Build Back Better plan could have significant implications for states on many fronts. One critical area to note is the basis of income tax law: establishing the definition of income that most states will use to administer their own income …

Egyptian MPs to draft amendment postponing capital gains tax law until 2023 – Politics – Egypt

[ad_1] The MPs, led by businessman and deputy chairman of the parliamentary industry committee Mohamed El-Sallab, said their legislative amendment followed an announcement by Finance Minister Mohamed Mait in early September that the new law on capital gains tax would be implemented in January 2022 as scheduled. “The announcement has hurt business and trade in …

How Higher Corporate Taxes and Personal Capital Gains Can Impact Indian Investors

[ad_1] US President Joe Biden has proposed an increase in corporate taxes to fund his social spending program. In addition, he proposed an increase in the personal capital gains tax to 25 percent instead of 20 percent. While increasing corporate taxes will surely have an impact on corporate profits, the question for all retail investors …

Taking the plunge and donating goods now could avoid a big capital gains tax bill – Jenny Ross

[ad_1] In the case of real estate (excluding principal residence), taxpayers at the base rate pay the CGT at 18 percent; higher rate taxpayers pay 28 percent. A I’m afraid the short answer is no, because HMRC treats a gift of property very similar to a sale, so you will be taxed as if you …

/cloudfront-us-east-1.images.arcpublishing.com/tgam/PP3OBBM67VDJLIKRRMGHORF6DY.jpg)

Should I trigger capital gains tax now – or wait until I’m gone?

[ad_1] My wife and I are in the early 1970s and have significant unrealized capital gains in our joint investment account. Is it advisable for us to cash in our winnings now and pay tax, or should we wait until we both die, when others will? The purpose of the sale now would be to …

How Proposed Capital Gains Tax Changes Could Affect Family Farms

[ad_1] Farmers and ranchers have watched with anxiety the development of the US plan for families. Potential capital gains tax changes have been a hot topic since President Joe Biden announced the plan in April. The proposal would subject accumulated gains in asset value to capital gains tax on the death of the owner of …

/https://specials-images.forbesimg.com/imageserve/61184c5c931401c2f3cbf648/0x0.jpg)

Critics sound the alarm over possible retroactive capital gains tax hike

[ad_1] Are retroactive tax increases constitutional or even fair? Until now, the capital gain tax rate was zero, 15% or 20% depending on your income. In some cases you add the Obamacare tax of 3.8%, but at worst your total tax bill is 23.8%. Long-term capital gains tax is progressive, 0% on income up to …

Use these two methods to reduce taxes on your capital gains

[ad_1] With big gains on investing in mutual funds, comes the pain of paying taxes on them. Capital gains realized in addition ??1 lakh on the sale of shares is taxed at 10%. However, with good planning, the same can be drastically reduced. Use these two methods to reduce taxes on your capital gains: Swap …