cagkansayin/iStock via Getty Images

The SPDR Portfolio High Yield Bond ETF (NYSEARCA: SPHY) is a simple high yield corporate bond index ETF. The fund offers investors a high yield of 5.8%, moderate dividend growth thanks to recent interest rate hikes, potential capital gains once bonds mature and bond prices recover, and is quite inexpensive, with an expense ratio of 0.10%. SPHY is a buy, and particularly appropriate for income investors and retirees.

SPHY – Basics

- Investment Manager: BlackRock

- Underlying Index: ICE BofA US High Yield Index

- Expense ratio: 0.10%

- Dividend yield: 5.75%

- Total returns (creation): 4.34%

SPHY – Presentation

SPHY is a simple high yield corporate bond index ETF. The fund tracks the ICE BofA US High Yield Index, an index of these same securities. This index includes all dollar-denominated bonds with lower quality credit ratings, subject to a basic set of liquidity, size and maturity criteria. This is a simple and broad index, and a decent benchmark for the US high yield corporate bond market.

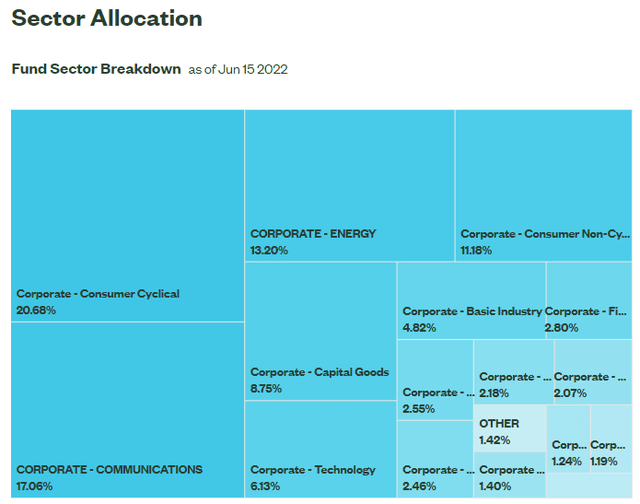

SPHY itself is an incredibly well-diversified fund, with investments in over 2000 stocks and exposure to all relevant industry segments. Concentration is also quite low, with the fund’s top ten holdings accounting for less than 3.0% of the fund’s value. Diversification reduces portfolio risk and volatility, a benefit for the fund and its shareholders.

SPHY company website

SPHY company website

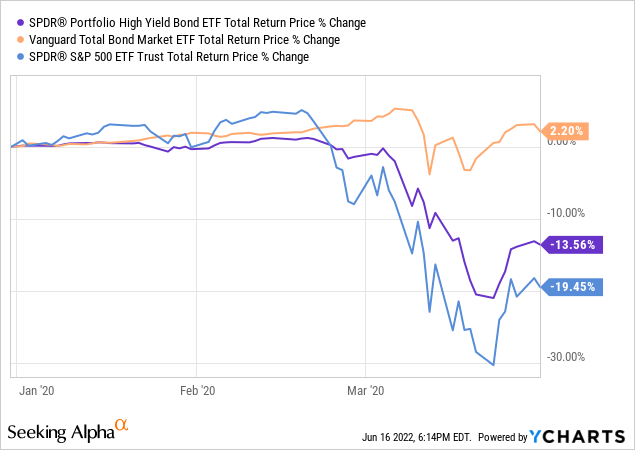

SPHY’s holdings are almost all lower-grade corporate bonds, issued by companies with weak balance sheets and finances, and with poor credit ratings. The risks are higher than average for a bond fund, but still lower than most equity index funds. Expect significant losses during downturns and recessions, somewhere between these two asset classes. This was the case in 1Q2020, at the start of the coronavirus pandemic, as expected.

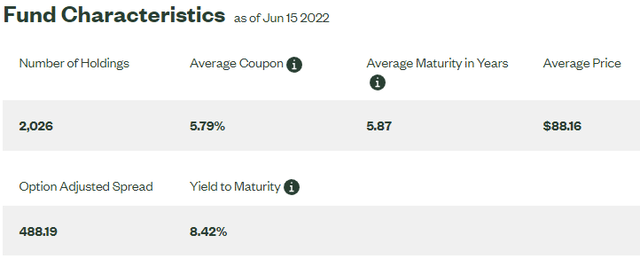

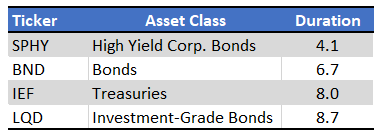

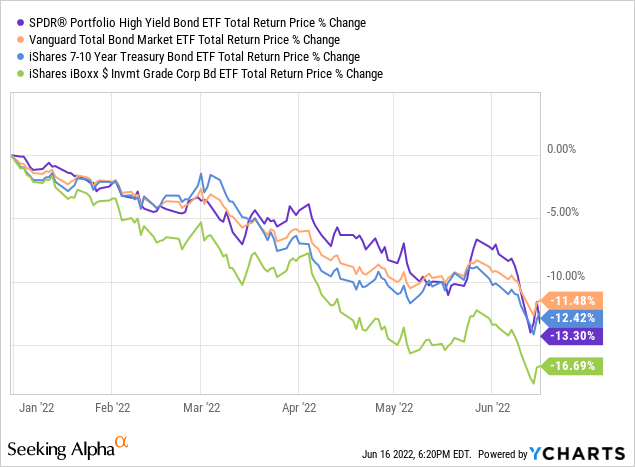

SPHY’s interest rate risk is below average, with the fund having a duration of 4.1 years, the lowest of its peer group.

Fund Filings – Table by Author

Expect moderate losses if interest rates rise, but these should be below average. Who has not This has been the case since the start of the year, as rising interest rates coincided with deteriorating economic fundamentals, reducing investor demand for relatively risky assets like high-grade corporate bonds. yield. Still, losses almost certainly would have been higher without SPHY’s relatively low duration, so this feature has been a plus for the fund and its shareholders in recent months.

Other than the above, nothing else stands out from SPHY’s index, holdings or strategy. It’s a simple high-yield corporate bond index ETF, and its holdings and characteristics reflect that. With that in mind, let’s take a look at the fund’s investment thesis.

SPHY – Investment Thesis

Strong dividend yield

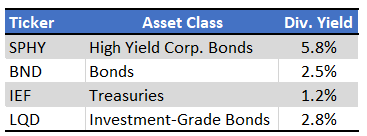

SPHY focuses on high yield corporate bonds which, as the name suggests, have relatively high yields. These translate into significant income for the fund and significant dividends for shareholders. SPHY itself has a year-over-year return of 5.8%, a reasonably good amount and a bit above average for a bond fund.

SeekingAlpha – Chart by Author

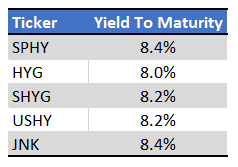

SPHY’s yield is also slightly above the average of a high yield corporate bond ETF. However, it is slightly lower than that of the iShares Broad USD High Yield Corporate Bond ETF (USHY), which posted a return of 5.7%. USHY is incredibly similar to SPHY, and another fantastic high yield corporate bond ETF.

SeekingAlpha – Chart by Author

SPHY’s above-average dividend yield of 5.8% is a benefit to the fund and its shareholders, and SPHY’s core investment thesis. The fund is an income vehicle, which you buy for performance.

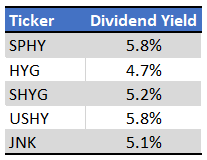

Moderate dividend growth

Rising inflation has led to higher interest rates, the Federal Reserve hiking rate in the last two months. Officials and analysts expect further gains throughout the year as the market pricing at a funds rate of 2.8% by the end of the year. Higher interest rates result in higher coupon rate payments for newly issued bonds, which, by increasing SPHY’s revenue, ultimately translates into higher dividends for shareholders.

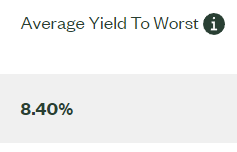

According to SPHY’s management team, the fund’s underlying holdings currently have a weighted average yield to maturity of 8.4%, slightly higher than the fund’s 12-month yield of 5.8%. The vast majority of ETFs distribute all income generated to shareholders as dividends, and SPHY is no exception. Thus, investors should expect the fund’s dividend yield to reach 8.4%, a significant benefit for shareholders.

SPHY’s dividend has seen some year-to-date growth, more or less as expected, but ETF dividends are somewhat volatile, so the growth could perhaps simply be a result of said volatility. Time will tell if the fund’s dividends grow significantly and sustainably, but I’m confident it will.

Potential capital gains

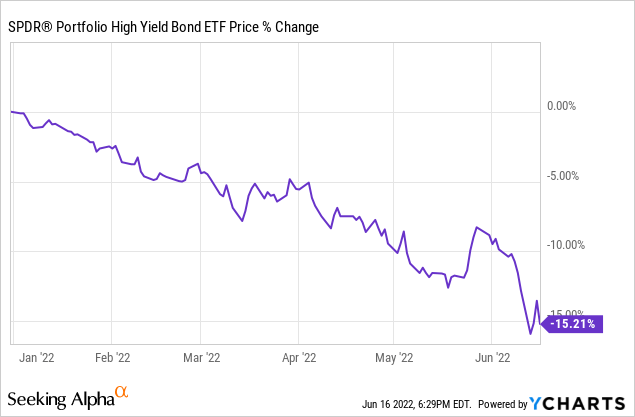

Rising interest rates, deteriorating economic fundamentals and bearish investor sentiment have led to a massive sell-off in bonds, with most bonds and bond funds suffering large losses since the start of the year. SPHY’s stock price is down 15.2% year-to-date, a reasonably large amount.

Importantly, only the link prices have fallen, investors still have to entire initial investment, despite recent losses. This means that investors will recoup most of the above losses once the bonds are redeemed, as the bonds are always fully redeemed at maturity. By my calculations, SPHY bonds will recoup about 12% of their losses at maturity, a reasonably good amount. SPHY bonds have an average maturity of around 6 years, so capital gains of around 2% per year on maturing bonds seem to be expected. Although these are relatively low expected capital gains, the gains are gains and investors still benefit.

Finally, we can add a fund’s underlying dividend yield and expected capital gains to arrive at an estimate of future total shareholder returns. This measure is generally referred to as yield to maturity or yield to worst. For SPHY, that would be 7.8%, or 5.8% + 2.0%. SPHY managers calculate the said metric themselves and come up with a figure of 8.4% for the same, a bit higher than mine due to expected/realized dividend growth (SPHY dividends have grown quite large since the start of the year, and dividend yields have yet to fully account of these higher dividends).

SPHY company website

SPHY’s yield to maturity is the highest among its peer group, so the fund has the highest expected returns to shareholders, a benefit to the fund and its shareholders. However, the differences are quite small.

Fund deposits – Table by author

Low spend rate

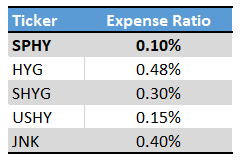

SPHY has an expense ratio of 0.10%, a relatively low amount and the lowest among its peer groups. Lower expenses always benefit shareholders and are one of the only surefire ways to increase returns. Dividends may still be cut, capital gains may not materialize, but lower spending still directly increases (reduces less) returns. A solid actively managed fund can generate enough alpha to overcome a high expense ratio, but that’s almost never the case for a simple, diversified index fund. As such, I’m generally drawn to cheaper funds when looking at index funds, and SPHY is no exception.

SeekingAlpha – Chart by Author

Conclusion – Buy

SPHY’s above-average yield of 5.8%, moderate potential growth in dividends and capital gains, and low expense ratio make the fund a buy.

/cloudfront-us-east-1.images.arcpublishing.com/tgam/PP3OBBM67VDJLIKRRMGHORF6DY.jpg)