Pgiam/iStock via Getty Images

Investment thesis

Discipline is an essential dimension of any investment strategy. Buy&Hold can work (at average or below market performance levels). But this can lead to the “long-term” trap of technology obsolescence, especially when coupled with an inflexible corporate management culture due to age seen at IBM., GE, J, PRD, XRX and others.

Active investing, where selections are continually needed to compete with alternatives, and are still subject to time limits tends to avoid this problem. And he stresses the reward advantage of taking gains when they appear, as (must be) indicated at the beginning of the capital commitment. Next, the expanded capital launches a freshly positioned competition for portfolio inclusion and performance.

We follow a standardized TERMD (Jime-Eefficient Risk-Mmanagement Ddiscipline) performance-based strategy. It is driven by our use of the price range forecasts stemmed from how high-volume and disruptive institution-driven “bulk” exchanges are to be conducted and accomplished.

They tend to put limits of the planned time horizon on decisions to the short-term 3-5 month period, which requires position reassessments more frequently than the practices followed by many individual investors.

But as this illustration shows, it can be a powerful advantage.

Description of primary investment security

Invesco DWA Energy Momentum ETF (NASDAQ: PXI)

“The fund will generally invest at least 90% of its total assets in the securities which make up the underlying index. The underlying index is composed of at least 30 securities of companies in the energy sector which present powerful relative strength or “momentum” characteristics.”

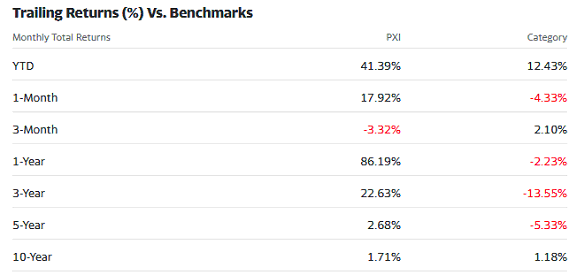

Source: Yahoo Finance, Morningstar

Yahoo finance

Note: these are period returns, not annual averages or CAGRs.

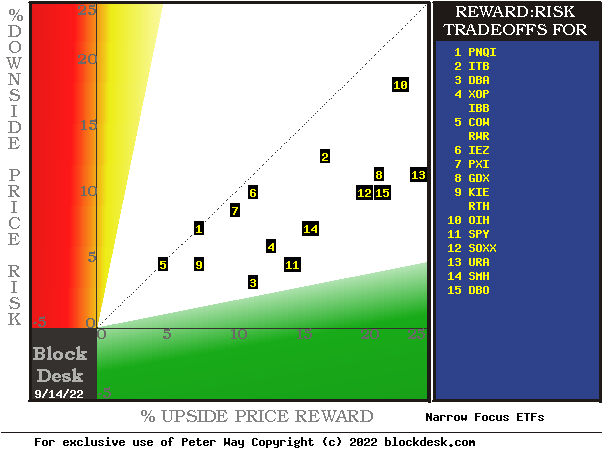

Comparable return and risk forecasts

Figure 1

blockdesk.com (Image used with permission)

The expected rewards for these securities are the largest gains over the current market closing price, which is worth protecting short positions. Their measurement is on the horizontal green scale.

The risk dimension is that of actual price declines at their most extreme while being held in the previous pursuit of upward rewards similar to those currently seen. They are measured on the red vertical scale.

Both scales are percent change from zero to 25%. Any stock or ETF whose current risk exposure exceeds its reward outlook will be above the dotted diagonal line. The attractive buying capital gain issues are found in the down and right directions.

Our primary focus is onsite PXI [1]by mistake on the diagonal line just above [5]. A standard “market index” of reward~risk trade-offs is offered by SPY at [9]. Most attractive (to own) by this Figure 1 view is BOD at location [7] but closer examination will show why this may not be so.

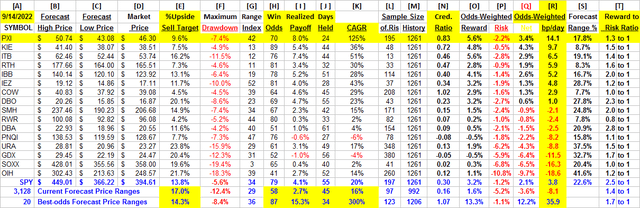

Comparison of characteristics of alternative investment stocks

The Figure 1 map provides a good visual comparison of the two most important aspects of every short-term stock investment. There are other aspects of comparison that this chart sometimes doesn’t communicate well, especially when broad market outlooks like SPY’s are involved. Where “likelihood” issues are present, other comparative tables, such as Figure 2, may be helpful.

Yellow highlighting of table cells emphasizes factors important to security valuations and to security PXI, most promising near-capital gain as ranked in column [R]. Filling pink cells indicates inadequate proportions of competitive critical performance requirements, as in [H], [L-N] and [T].

Figure 2

blockdesk.com (Image used with permission)

The price ranges implied by the day’s trading activity are in columns [B] and [C]usually surrounding the day’s closing price [D]. They produce a measure of risk and reward that we call the Range Index [G]the percentage of forecast range B to C that falls between D and C.

Today’s G’s are used for the last 5 years of each stock’s daily forecast history [M] count and average before [L] experiences. Less than 20 G or a shorter history of M is considered statistically insufficient.

[H] indicates what percentage of L positions were profitably completed, either at prices above the range or at the market close above the next day’s entry costs of the expected closing prices. The net realization of all the L’s is shown in [ I ].

[ I ] fractions are weighted by H and 100-H in [O,P, & Q] suitably conditioned by [J] to provide a ranking of investments [R] in CAGR units of basis points per day.

The pink cell highlight provides fatal investment valuation conditions for several candidates, including the occasional market index ETF SPY. Additional market perspective is provided by the more than 3,000 stocks for which price range predictions are available. They currently suggest that while the market rally is underway, it is still far from generally attractive.

On the other hand, the R column scores for the PXI and population of the top 20 predictions confirm the competitive ability of the lead candidate and indicate the presence of several other demonstrated prospects.

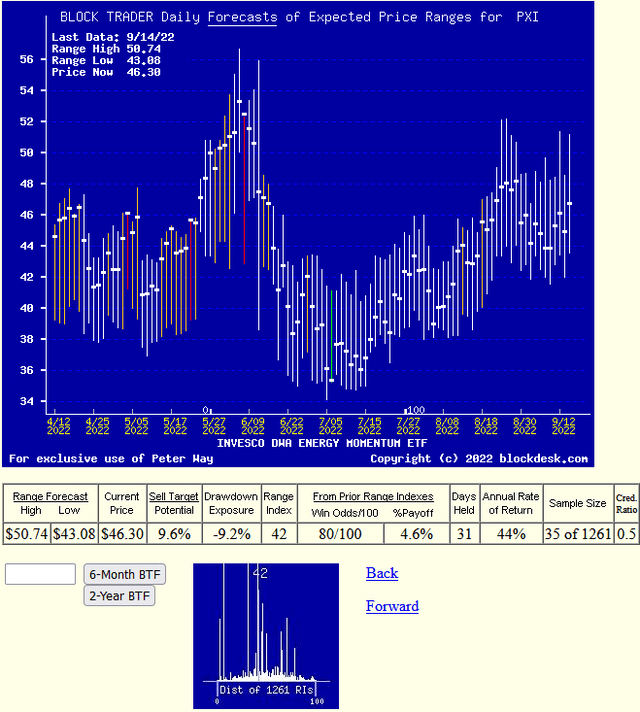

Recent trends in Price Interval PXI Forecast

picture 3

blockdesk.com (Image used with permission)

The vertical lines in Figure 3 plot the daily update forecast price ranges for PXI in the coming months, as implied by the active hedging of ETF volume block trades traded between institutional investors.

The ranges are bifurcated by the closing price on the forecast day.

This visually divides them into bullish and bearish outlooks.

These forecasts are typically resolved in time horizons of less than six months, and often in two months or less. This one indicates that out of the previous 35 forecasts like today’s, most were realized in 31 market days (6 weeks) profitably with +4.6% average earnings, CAGR by +44%. No promises, just fun with the story.

Key takeaway for investors

Comparison of the performance of Market Makers forecasts in the short term for Invesco DWA Energy Momentum ETF with similar predictions of other technologically active stocks being pursued by investor referencing, it seems clear that this stock may be an attractive investment choice for investors pursuing short-term capital gain strategies.