Stock market regulator NZ RegCo is urging investors to seek professional advice if they plan to participate in Air New Zealand’s capital raising and rights trading for new shares.

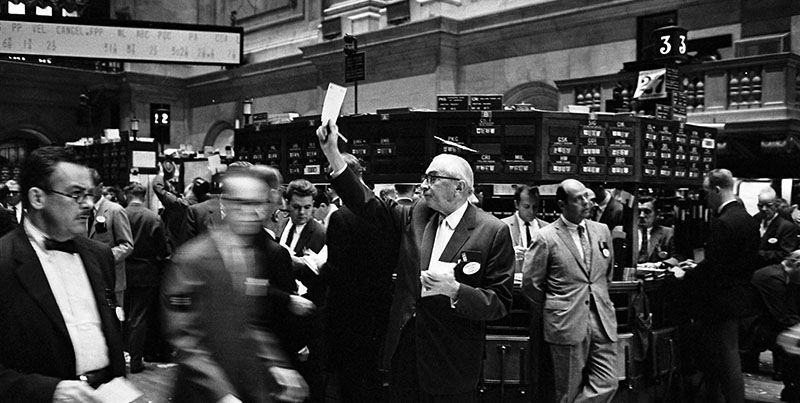

Photo: 123RF

The confusion was caused when the stock exchange operator, NZX, offered the wrong benchmark or notional starting prices for Air New Zealand ordinary shares and for the tradable rights to purchase new shares.

NZX apologized for the errors and inconvenience caused. Common shares of Air New Zealand traded, but rights did not, while confusion and errors were resolved.

NZRegCo, which operates independently of NZX, said investors should review key information about Air New Zealand’s offering structure.

“NZ RegCo considers that the information may not have been viewed and considered by certain investors,” it said in a statement.

He said important details were included in documents issued by Air New Zealand, which investors were encouraged to review before making any investment.

“Investors are strongly encouraged to access and read this information, and to seek professional advice, before making any investment decision regarding the AIR rights offering.”

Under the rights offering, eligible shareholders receive one right to waive for each existing Air New Zealand share. This right allows them to buy two new shares of the airline at 53 cents each, which will earn the airline $1.2 billion.

The rights, which received a confirmed reference price of 49 cents each yesterday, were listed with buyers ready to pay 65 cents each while sellers were looking for just under 88 cents. No transactions had been concluded at the start of trading on the market.

Air New Zealand common shares rose 5% to 95 cents apiece in early trading, indicating a measure of investor optimism.